Financial authorities are rushing to catch up to scammers swiping millions from Singapore bank customers.

Singapore’s Monetary Authority and Association of Banks will reinforce the security of digital banking with new preventive measures within the next two weeks after close to 500 bank holders were scammed for over S$8.5 million (US$6.3 million) in recent phishing scams.

“The growing threat of online phishing scams calls for immediate steps to strengthen controls, while longer-term preventive measures are being evaluated for implementation in the coming months,” the authority wrote last night.

Due to the recent spate of SMS-phishing scams targeting OCBC Bank holders, banks in Singapore will cooperate to put in place more stringent measures such as removing links sent via email and SMS to customers, letting customers set thresholds for transfer notifications to under $100, and implementing delays before activating new software tokens on devices.

Notifications will also be sent to customers when there is a request to change their mobile number or email address, and a cooling-off period will be implemented between requests for key account changes like contact details.

Dealing with potential fraudulent cases will be set as a priority for banks’ customer service teams, and alerts educating customers about scams will be sent more frequently.

The monetary authorities reminded customers to remain vigilant and never click on links provided in SMS or emails, share internet banking details, and closely monitor transaction notifications and report unauthorized transactions ASAP.

The police said late last month that at least 469 OCBC bank customers were scammed through SMS, with losses totaling at least S$8.5 million.

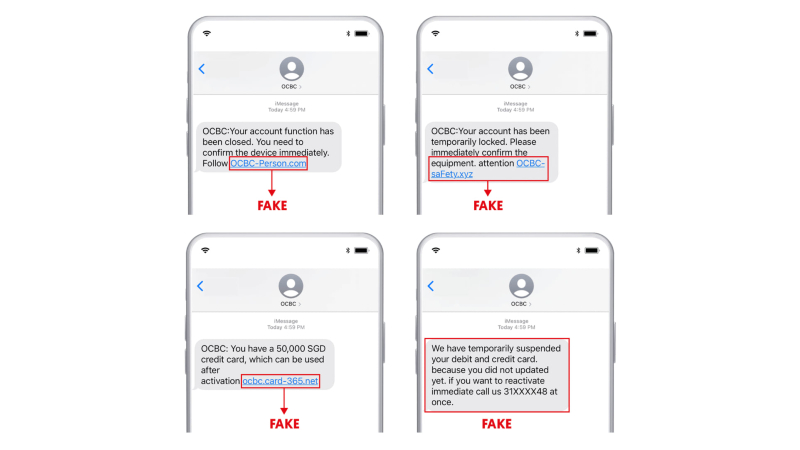

The scammers sent out fake bank alerts that led to a bogus OCBC website where customers were asked to key in their personal account information. Customers then realized they were scammed after receiving notifications that unauthorized transactions had been charged to their accounts.

OCBC Bank said yesterday that all affected customers will receive “full goodwill payouts” covering the amounts lost, but customers told reporters they could not disclose how much was returned after signing non-disclosure agreements.

The bank has sent payouts to more than 100 victims so far since Monday, and plans to reach all those affected by next week.

Another recent scare involved Google searches returning fake bank hotlines in the results. According to the police, there are at least 15 victims who lost a total of S$495,000.

Other stories you should check out:

Charles Yeo charged with harassing police officer and ‘homophobic’ Christians

Ooh la la! French Fold opens at Palais Renaissance

NTUC FairPrice ups its marketing game with Wordle fun