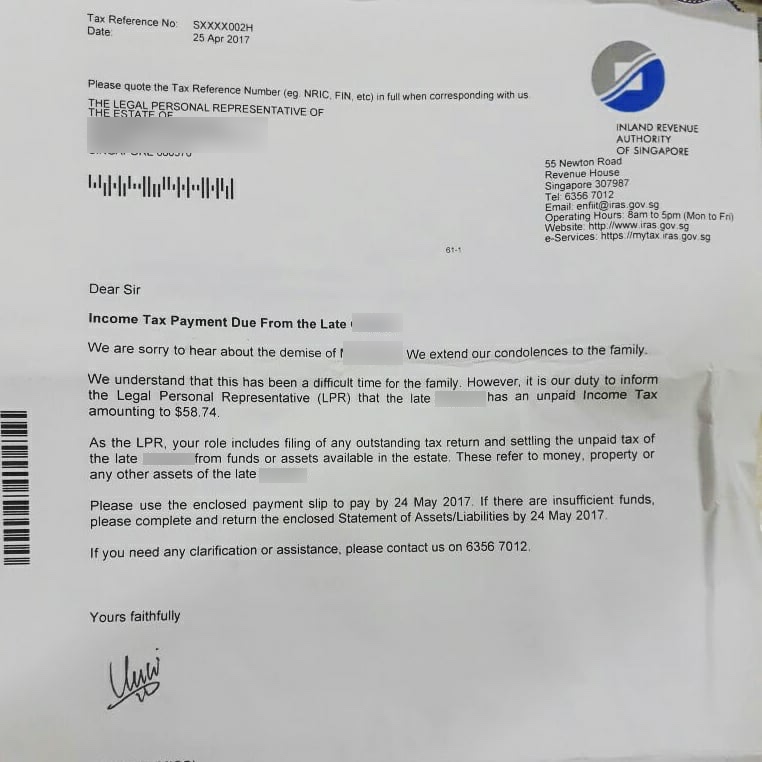

Like ol’ Ben Franklin said: in this world, nothing can be said to be certain, except death and taxes. Nothing encapsulates the mantra more than this viral post on Facebook — a letter sent by the Inland Revenue Authority of Singapore (IRAS) requesting $58.74 in unpaid income taxes on behalf of a deceased individual.

A netizen went ballistic on Facebook, expressing his displeasure at getting a letter from the IRA to pay the remaining taxes on behalf of the deceased.

“This is exactly why I’m so damn proud to tell everyone I’m a Singaporean! Work till die just to pay and pay. After die also still pay. Lol.. Where in the world you can find so hard working citizens?” he wrote.

The image he posted may or may not be true, but what’s true is that the tax matters of any deceased individuals do need to be settled — including the filing of personal income tax and trust income tax. All income up the date of death has to be reported, while all entitled credits and deductions can still be claimed. It’s not just Singapore — folks in other countries also need to file final income tax returns upon death. In other words, the complainant’s anger is more than just a little misplaced.

It could have been a lot more than just $58.74, really. Prior to 2008, Singaporeans had to cough out even more with Estate Duty: the tax on the total market value of a person’s assets (cash and non-cash) at the date of his or her death.

Reader Interactions