It seems like Singapore Airlines (SIA) isn’t getting off to a good start this year. Shortly after making headlines for receiving backlash and subsequently ditching its plan to impose credit card surcharges for flights departing from Singapore, the harried national carrier got on customers’ nerves once again by rolling out its new online booking feature that automatically includes travel insurance.

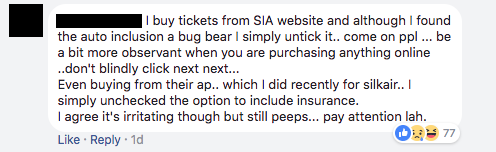

Yep, instead of opting in for the travel insurance, you’ll have to click on a button to opt out, which apparently some patrons missed during their booking and only realized it after the confirmation. But once payment has been made, it’s just extra hassle to request for a refund.

According to The Straits Times, this feature was actually introduced last year in Singapore, Thailand, and Hong Kong. But unhappy SIA customers have been writing in to the publication recently about how they were caught unaware and had to go through the tedious process of getting a refund.

In response, SIA said that it encouraged (of course) customers to get travel insurance.

“The inclusion of insurance is clearly displayed, the cost is reflected in the booking summary panel at the payment page, and customers can opt out if they do not wish to add the insurance to their booking,” a spokesman explained, in a bid to defend the company’s move.

He also added that customers can cancel even after payment has been made, and refunds will be credited to their credit card within 10 working days.

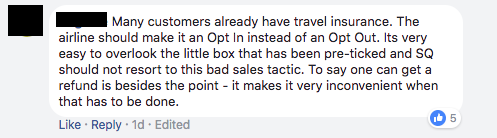

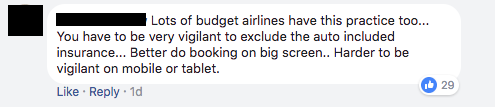

Although some netizens were put off by the new feature and how it made SIA look, others simply brushed it off and warned potential customers to be more vigilant in looking out for extra costs when making a booking.

Wong Dick says

As those who are affected by the automatic insurance inclusion, you may want to check with Monetary Authority of Singapore (MAS) who is the supervisory authority for matters concerning insurance. I recall there are certain conditions to be met before a policy purchase is considered valid.