In an update by the Consumers Association of Singapore (CASE) over the ongoing non-fulfillment of deposit refunds by oBike to its former users, the consumer watchdogs have revealed some further details about why the process is taking so excruciatingly long.

Since the bike-sharing firm announced last Monday that it’ll be shuttering its Singapore operations, users have been up in arms over the extreme difficulties in getting back the money they’ve put in to use oBike’s services. Thousands of users paid mandatory deposits ranging from $19 to $49 — all in the company’s bid to ensure “responsibility while using (their) service”.

$6.3million is the amount that oBike currently owes its former riders, with company chairman Shi Yi simply offering good intentions and promises instead of foreseeable solid plans to roll out the refunds. According to him, the company is trying to raise money from its shareholders to replace the money they owe to an estimated 100,000 former customers. The Land Transport Authority (LTA) directed disgruntled users to lodge their complaints to CASE — a non-governmental organization without legislative powers.

An update provided by CASE yesterday revealed even more disappointing details about the ordeal with oBike. According to the consumer watchdog body, our deposits have been used up by oBike to expand their bicycle fleet and fund their operations. In other words, the money we put into the service to pay for future bike rides was apparently used for other means.

“CASE has communicated clearly to oBike that this practice is unethical and unacceptable, as the refundable deposit acts as surety for consumers to be responsible when using the bicycle-sharing service, and should not be used for other means,” wrote the NGO in their statement.

“Using these deposits to purchase bicycles and fund their operations means that oBike would be financially hard-pressed to provide the deposit refunds to consumers without new sources of funding”.

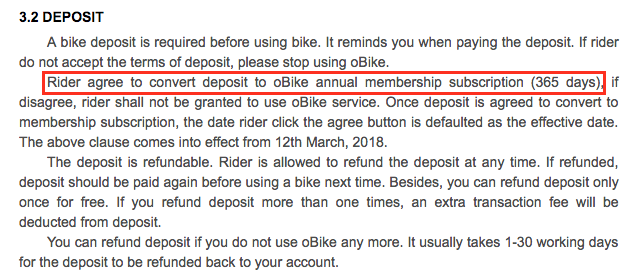

CASE also found fault with oBike’s controversial insertion of a clause (dated March 12, 2018) to automatically convert deposits into membership subscriptions without explicit user consent. It’s the very same issue faced by customers in Melbourne after the bike-sharing company pulled out from the market — deposits were turned into long-term subscription plans without their knowledge.

“By inserting such a clause in the Agreement and using the deposit to offset the payment of membership fees, CASE is of the view that oBike has breached paragraph 22 of the Second Schedule of the Consumer Protection (Fair Trading) Act, which prohibits a supplier from asserting a right to payment for the supply of unsolicited service,” CASE wrote.

Hot damn, were we all taken for a ride all this while? Maybe we should have paid closer attention to oBike’s Bicycle Rental Service Agreement, which states that the company has the right to “amend, modify or change” the contract at any time without “any notice or cause”.

The agreement also affirms that the company is contractually obligated to refund user deposits should they choose not to use the service anymore — a process that “usually takes 1-30 working days” for the money to be returned.

At this point in time, things are looking a bit bleaker for the situation with our deposits being refunded. After all, the company has other debts of higher priority to handle, such as the hefty fines it currently owes to various town councils and potential fees owed to LTA for any failure to remove its bicycles from public areas.