On Monday, Uber services were terminated in Singapore. It took a while for the ride-hailing giant to make an exit here, relative to other Southeast Asian countries — an exit postponed due to a review by market watchdogs Competition and Consumer Commission of Singapore following Grab’s acquisition.

On that very same day, Grab — now the biggest ride-hailing service in the country — announced that they have been rolling back discounts for riders and incentives for drivers. Who could have ever foreseen this?

Well, almost everyone. Immediately after they officially won the long battle against Uber back in March, Grab assured users that there will be no changes at all to fares. “We are maintaining our fare structure and will not increase base fares,” they wrote in their FAQ section.

Fair enough — but what most users expected to happen was that Grab would no longer offer the usual discounts and promo codes they put out on the regular to entice riders against using Uber. Without a solid competitive rival though, why would Grab want to offer any more discounts? Folks here won’t have any other choice for a reliable ride-hailing service anyway.

With over 84,000 subscribers, Telegram group @SGCabPromos has frequently chimed with promotional codes by Uber and Grab to be redeemed for discounted rides. Today, it’s a barren wasteland filled with occasional promo codes for ComfortDelGro cabs and none at all for Grab.

The rollback

In a media interview held on Monday, Grab Singapore head Lim Kell Jay claimed that incentives and promotions have been “trending down” for a while even before the acquisition of Uber’s Southeast Asia operation, The Straits Times reported.

According to Lim, the company has no interest in participating in price wars and thus have been cutting back discounts for customers. Oh, and the decision apparently has nothing at all to do with the virtual monopolization they now wield in the ride-hailing market here, because the winding down of discounts and incentives has been happening for some time prior to the Uber deal.

The benefits they want users to focus on now is through their GrabRewards, the system that rewards users with points that can be used to redeem prizes such as fare discounts and priority bookings.

“It’s more exciting that way, rather than just promos,” Lim enthused.

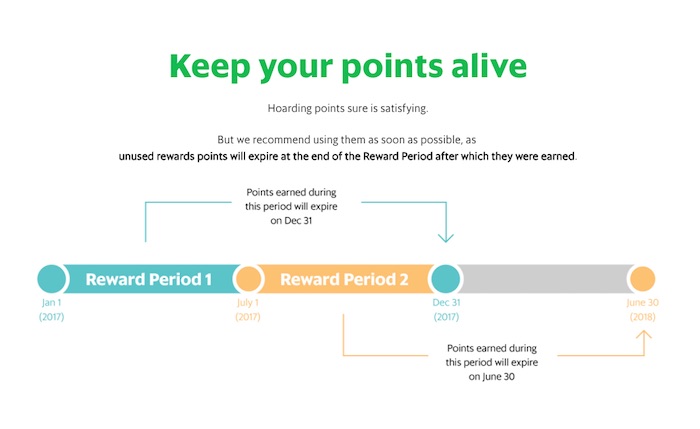

How do people earn these points? Why, by using all of Grab’s services, of course. The more you spend on Grab rides, GrabFood orders, GrabCycle bikes, and utilize the GrabPay e-wallet system, the more points you receive. To ensure that users keep using Grab services, unused rewards points have an expiry date — so if you’re not redeeming those points, they’ll be gone after a certain period. Other rewards that can be redeemed include Cathay movie tickets, Spotify Premium memberships, and even KrisFlyer miles with Singapore Airlines.

It makes perfect business sense for Grab, of course — a loyalty rewards system ensure that users will be caught in a loop to keep using their services regularly. But for users who aren’t interested at all in getting into Grab’s ecosystem, rides won’t be as easily affordable as it was before, even though the company kept to their word of not hiking up fares.

Sure, fare discounts will still be around. What you need to acquire them, however, is to be a fiercely loyal, heavy user.

Grab gripes

Experts seem to agree that this might not look so good for Grab. Speaking to Business Times, National University of Singapore (NUS) assistant professor Lawrence Loh believes that it’ll drive users away.

“Although Grab claims that the cut-downs were already in the works for some time, the timing is certainly not conducive. It further reinforces the ongoing concern that Grab is exercising its position of market dominance,” said Prof Loh.

“More importantly, it may sow the seed for both riders and drivers to switch to competitors.”

Yang Nan, another NUS assistant professor, told ST that with fewer customer promotions, demand will fall — and this will result in fewer jobs for drivers. Grab drivers will, in turn, quit due to the lack of potential income.

A healthy competition

Already, other ride-hailing companies have been sniffing out the grounds to make a big push into the local market. Homegrown carpooling app Ryde announced the launch of a new private-hire service called RydeX; India’s Jugnoo promises to bring a unique reverse-bidding model to ride-hailing; Singapore startup Filo seeks to launch private-hire car booking services that will be “cheaper than taxis”.

The biggest titan that could actually take on Grab, however, is Indonesia’s Go-Jek, who are currently in talks with ComfortDelGro for a potential partnership. The fact that Google invested about S$131 million into Go-Jek means that it could very well be in a position topple Grab from its possible short-lived throne in Singapore.

Editor’s Note: Article amended to correct a factual error. We apologize for the inaccuracy.