This article was first published on Dollars and Sense

Every year without fail, Singaporeans can look forward to payouts given to them through the GST Voucher scheme.

And the same question is asked each year, “How much money will I be receiving?”

What is the GST Voucher Scheme, and why is it important?

Introduced in the Singapore Budget 2012, GST Voucher (GSTV) is a permanent scheme that aims to help lower-income Singaporeans cope with living costs associated with the Goods & Service Tax (GST).

Though it’s the cash component that always gets the most attention, the GST Voucher actually comprises three separate components – namely, Cash, U-Save, and Medisave.

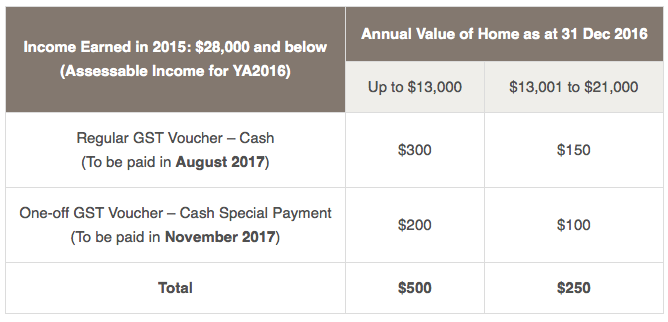

2017 GST Voucher – Cash

Lower-income Singaporeans will receive a cash payout from the government.

2017 GST Voucher – U-Save

Lower and middle-income Singaporean HDB households will receive quarterly rebates to help them offset their utilities bills. This is paid in January, April, July, and October. As announced at Budget 2017, there will be a permanent increase of between $40 to $120 to the annual amount of U-Save rebate.

2017 GST — Medisave

If you are 65 and above, you will receive a top-up to your Medisave Account. This is paid in August.

Ongoing support

As a permanent scheme, the support provided by the GST Voucher is ongoing. That makes it a sustainable form of support, rather than just a temporary one.

In some years, the Government may provide additional one-off GST Voucher payments. For 2017, there is an additional Cash Special Payment of between $100 to $200 for eligible GST Voucher – Cash recipients.

Who is it for?

As mentioned above, the GST Vouchers are primarily meant for lower-income individuals in Singapore. In addition to not owning multiple properties, two main criteria are used to determine the GSTV – Cash eligibility.

(1) Annual Income Earned (based on Assessable Income for YA2016): Singaporeans who earn $28,000 and below will meet the first eligibility criteria for GSTV – Cash payout. The payout in 2017 will be based on assessable income for YA2016, which in turn, is based on income earned in 2015.

(2) Annual Value Of Home (as at 31 Dec 2016): Singaporeans who meet the first criteria and whose annual value of home is $13,000 or less (if you stay in a HDB flat, your home annual value would be less than $13,000) will be entitled to the highest amount of cash payout (from GSTV – Cash and Cash Special Payment), which is $500 in total for 2017. Those whose home has an annual value of between $13,001 to $21,000 will receive a total of $250.

Even if you are not eligible for the GSTV – Cash payout, you may still be entitled to receive the GSTV – U-Save rebates. This rebate is given to all Singaporean HDB households, unless they own multiple properties. It’s helpful in offsetting utility bills, and the actual rebate amount will vary depending on flat size.

Singaporeans aged 65 and above with an annual home value not exceeding $21,000 will also receive a Medisave top-up, as long as they do not own multiple properties.

When do I get the payout?

Both the regular Cash and Medisave top-ups will be paid out in August while the U-Save rebate is paid out in January, April, July and October each year.

One-off payments, whenever applicable, may be made on a separate month as announced by the government.

For GST Voucher 2017, timeline for payments are as follows.

Where Will The Money Be Paid Into?

Having a designated bank account for the money to be credited into your account would be the most convenient way for you to receive your GSTV – Cash payout. This will be faster and more convenient compared to the hassle of waiting 2 additional weeks for the cheque to be mailed to you and having to cash it in at the bank.

By default, your designated bank account would be the last account that has been used to receive payout from the government. If you wish to check or change the bank account, you can do so at the GST Voucher website.

How Will I Be Notified?

From July 2017 onwards, an SMS notification service will be introduced to provide timely updates to Singaporeans regarding GST Voucher – Cash and Medisave. Those up to the age of 55 will receive SMS only, while older recipients will receive both letters and SMS.

Through the SMS notifications, you will be informed if you qualify for the GST Voucher – Cash and Medisave, and when the GSTV – Cash payments have been credited. This is faster and more convenient than having to wait for the notification letters to arrive in your mailbox.

SMS notifications will be sent to the mobile number that you have registered for your SingPass Account.

If you have yet to register your mobile number with SingPass, notification letters will continue to be mailed to you. To be able to receive timely SMS notifications on your GST Vouchers in the future, simply log on to the SingPass website to register your mobile number. Once you have done so, you can enjoy greater convenience and also do your part for the environment by reducing paper usage!

DollarsAndSense.sg is a website that aims to help people make better financial decisions. If you like what you read, subscribe to the Dollars And Sense Newsletter.

Story: Timothy Ho via Dollars and Sense

Reader Interactions