You know the type: insurance agents, now commonly fashioned as “financial advisors,” typically inundate social media with all types of financial tips and tricks in a bid to attract prospects to get ahold of their insurance plans.

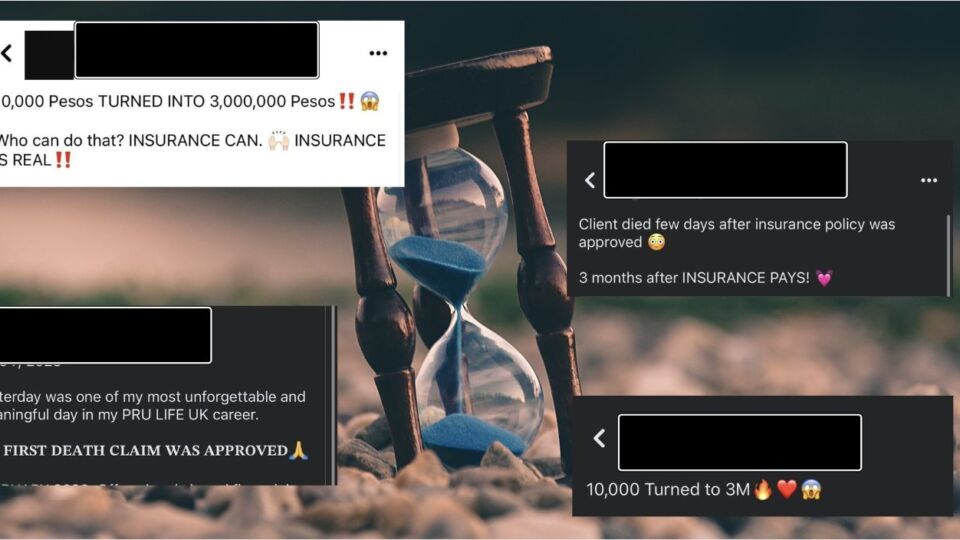

But when a client met an untimely death within the same month his policy was issued, a financial advisor took to social media to share “one of the most meaningful and unforgettable day[s] in her career” — her first death claim approval under her insurance company, Pru Life UK.

The agent shared that her client signed up for an insurance plan in February, and received the policy in March after paying a premium of PHP10,000 (US$180). The client died later that month.

In June, the beneficiaries’ death claim was approved and they received a check of PHP3 million (US$53,847) in insurance coverage.

The post was apparently shared by several other financial advisors, writing comments such as, “From 10K premium to 3M life insurance proceeds for the family. Thanks Prulife!”

Others used emojis such as exclamation marks and shocked faces.

“PHP10,000 turned into PHP3,000,000. Who can do that? INSURANCE CAN,” one wrote with a hands-up emoji. “INSURANCE IS REAL!”

“Can we have sensitivity training for your insurance agents?” Ferdinand Estrella wrote on Facebook. “Or even emoji use training. People DIED and this is what they’re doing. Imagine being a family member of the deceased and their insurance agent shares this shit,” he added.

“Imagine someone dying and a person using his death as a sales pitch,” one wrote.

“The point is etiquette. Nothing wrong with getting insurance. But it’s weird that death is being used to sell and make money. When it comes to money matters, people become insensitive.”

Yet others, many of them also insurance agents, came to the agents’ defense and said there was nothing wrong with their posts.

“There’s nothing offensive there. You people are over-sensitive. The client was not identified,” one defended.

“I’m sorry to those who got offended, but please don’t generalize all insurance agents or the companies. They made a mistake, but I think what the author wants to show is how important having life insurance [is]. I don’t think there is an agent who is happy about filing death claims. Aside from the fact that it takes up a lot of work, we don’t want our clients to experience that,” another explained.