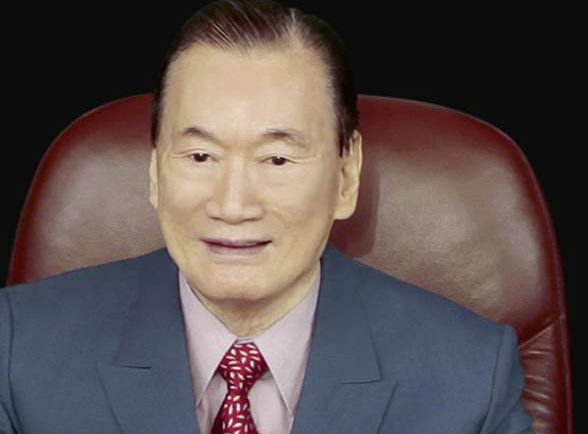

This story and photograph first appeared on Asian Dragon Magazine (Jul-Aug 2012) and is being reprinted exclusively with their permission.

His enormous business interests span several fields, from shipping and pharmaceuticals to publishing and tourism, but success came only with persistence and hard work. Today, as he turns over the daily operations to his children and grandchildren, Don Emilio T. Yap continues to help build the nation that gave him the opportunity to excel.

It would be difficult to find any taipan whose businesses are as formidable and diverse as those owned by Don Emilio T. Yap.

He has successfully run a vast empire that includes shipping (Philippine President Lines), pharmacy (Euro-Med Laboratories), banking (Philtrust Bank), publishing (Manila Bulletin), tourism (Manila Hotel), and education (Centro Escolar University), to name a few.

With an estimated net worth of $1.1 billion (P46 billion), he was recently listed as the 15th richest Filipino in 2012 by Forbes magazine.

At 86, the very slim and dapper Don Emilio is still a bundle of energy. He continues to drop by his various companies to attend their respective board meetings, but emphasizes that he has already turned over day-to-day operations to his children and grandchildren, supported by an efficient team of professional managers.

Unlike other seniors his age, Don Emilio isn’t one to sit out the social scene. He makes it a point to attend events that mark important milestones of companies. Recently, he was seen toasting a glass of champagne along with family members and managers to mark the 100th anniversary of Manila Hotel.

His first grandson and namesake, Emilio C. Yap III, who oversees the Manila Bulletin, says that Don Emilio still has a very sharp and inquisitive mind. He talks to Emil every day, about concerns in their various companies.

Don Emilio’s success may be attributed to his persistence and hard work, heightened with a boldness to take risks in industries that he initially may not have been familiar with. These “crazy ideas or crazy solutions,” don’t seem to make sense in the beginning, but eventually turn out to be right.

Born in the Fujian Province of mainland China, Don Emilio later became a naturalized Filipino, and has since dedicated his life and career to nation-building. Having flourished in his adopted home, Don Emilio considers it his patriotic duty to protect the Philippines’ image abroad, and its government’s reputation among fellow Filipinos.

In his own words — the words of a true taipan — Don Emilio gives us an insight into his life and career.

Can you give us a brief summary of your life story?

I was born in Fujian Province, China. My father was a teacher, and it was my mother who nurtured me while my father traveled around the country to teach. I was their only child. My grandfather used to own a trading shop in Manila. The first time I went to Manila, it was to study. I returned to Fujian when my grandfather’s shop closed down. My second trip to Manila was funded by my mother’s brother, who sold a parcel of his land for my ship’s passage. From Manila, I traveled to Dumaguete, where I tended shop for a trader.

When World War II broke out, I found myself moving from Cebu to Manila, where I worked as a master cutter for a T-shirt manufacturer. Eventually, I took charge of the T-shirt company and started making white T-shirts, which the Japanese soldiers liked so much. It was wartime, and our white T-shirts were selling like hotcakes to the Japanese. With the proceeds from the T-shirts sale, I was able to gather enough capital to start a business of my own. I started selling the basic component of T-shirts, which is thread, and eventually, I also sold ballpens and watches.

After the war, my biggest break in trading came when I began to buy and sell surplus vehicles like the wartime G.I. jeeps and trucks. It was for this purpose that I established the U.S. Automotive in 1947 and became one of the biggest buyers of surplus vehicles in the world. I was good at bidding, I was told, and I used this skill in all my buying trips abroad. In 1960, I ventured into shipping after I realized that we needed ships to carry freight. And thus was established Philippine President Lines. In 1961, I was invited by Gen. Hans M. Menzi to invest in the Manila Bulletin. In 1978, I invested in Philtrust Bank. In 1988, Euro-Med, a pharmaceutical company, was established by my eldest son, Emilio Jr. In 1995, I successfully acquired a majority share at the Manila Hotel. In 2002, the Centro Escolar University was added to our conglomerate.

To what factors would you say you owe your success?

I have always played by the Golden Rule, as taught to me by my parents. It was also deeply ingrained in my mind by my parents to always do good to others. Persistence is another trait that helped me get to where I am now.

Are there any particular people who helped you in your success?

There are a lot of people I had the good fortune of working with, and who helped me, and I am grateful to all of them.

In your lifetime, you have established many great businesses. Is there one that you consider definitive, or one that you are most proud of?

All the business that I established, I am proud of, because each came to fruition after years of hard and painstaking work. I can never single out one of my businesses as a favorite, because all of them were fruits of my labor.

What do you see for the future of the Manila Bulletin, in light of the changes in the newspaper industry, such as online news?

The Manila Bulletin was established in 1900 and will continue to be a partner in nation-building. The future of the Manila Bulletin will continue to lie in its content. We are proud of our people. We are proud of what we put into the newspaper, and it will continue to supply the news in whatever channel. Nothing has changed. A newspaper is not a one-dimensional product. It’s print plus more.

What is your strategy for Philtrust Bank? How will it compete with the other major banks? You are said to own a lot of prime property, particularly in the City of Manila, through the bank. If so, what are your plans for these properties?

In 1978, we acquired the majority interest in Philippine Trust Company (Philtrust Bank) from the Archdiocese of Manila, adding banking to our business interests that till then had been in the shipping, newspaper, and automotive industries.

As Bank Chairman, I emphasized the new management’s commitment to place primary importance on its responsibility of safeguarding depositor funds, even as it actively competes with other financial institutions. We outlined a long-term strategy of generating additional business by expanding both services offered and more branches in Metro Manila and other business centers. Key to the strategy was the maintenance of the conservative policies of the bank, placing capital and depositor funds only in government securities and with top-grade borrowers.

The bank has since grown from strength to strength. The growth of the bank can be seen in its resources: P1.73 million in 1920, P119.5 million on its 50th anniversary in 1966, P529.7 million in 1978 when the present management took over, P6.443 billion on its 75th Anniversary in 1991, P55.072 billion on its 90th anniversary in 2006. As of March 31, 2012, the bank had total resources of P103.7 billion, deposits of P87.6 billion, capital accounts of P15.4 billion. It had net after-tax income of P2.0 billion for in the preceding year 2011.

In 1982, the head office was transferred to its present location at the corner of United Nations Avenue and San Marcelino Street. In 1978, Philtrust Bank had a network of nine branches; now it has 55 branches all over the Philippines, the most recently opened ones being in Malabon and Naga City.

Philtrust Bank’s history parallels that of the Philippines and the Philippine banking system. It began operations on October 21, 1916 with paid-up capital of P500,000 in a small office on Calle T. Pinpin corner Muelle del Banco Nacional off Escolta in Manila’s central business district. In 1919, the company went into full-fledged commercial and savings banking, occupying offices at the center of Manila’s business district, between Sta. Cruz Bridge and the Escolta.

We grew rapidly during the American Regime and the Commonwealth Period, but like the rest of the country, Philtrust Bank experienced the hardships of World War II that began on December 8, 1941 with the Japanese attack on Pearl Harbor. Premises and records were destroyed in the Battle of Manila in February 1945, but its officers and staff regrouped to begin the challenging work of building the bank from the ruins of war.

In the post-war decades of economic rehabilitation and development, Philtrust Bank was consistently rated as one of the most outstanding Philippine banks, especially for its strong liquidity position. It has been a byword for banking conservatism and reliability, proof of the maxim, “make haste slowly.” The bank’s guiding principle, of never taking undue risk with depositor funds, has succeeded, with the result that the bank has enjoyed the trust and confidence of the business community and the general public. It has no local and foreign loan or guarantee obligations, has never borrowed or availed of any rediscounting facility from the Bangko Sentral ng Pilipinas or other banks. Rather, it has been a consistent lender to the banking system.

The BSP granted Philtrust Bank a universal banking license in 2007. In 2010, I assumed the post of Chairman Emeritus, relinquishing the chairmanship to Dr. Jaime C. Laya, former chairman of the Monetary Board and governor of the Central Bank of the Philippines, assisted by Supreme Court Justice Josue Bellosillo (Ret.) and with experienced international banker Basilio Yap as vice chairmen. Other board members are Congressman Tomas V. Apacible, Messrs. Ernesto O. Chan, Mariano L. Crisostomo, Jose M. Fernandez, Dr. Emilio C. Yap III, Dr. J.R. Yap, and Ms. Miriam Cu. With its present solid position and leader- ship, the bank looks forward with confidence to the years ahead.

What are your plans for Manila Hotel?

We will continue to upgrade its facilities, since it is a service business, and we will capitalize on it being the Grand Dame by the bay. We will maintain its history hand-in-hand with modernizing its facilities.

Manila Hotel’s rich history sets it apart from all other hotels in Metro Manila. The fact that the Philippine government declared it a historical landmark in 1997 says it all. And though the hotel is proud of this heritage, it also aims to keep up with the changing standards of five-star hotels.

For the past four years, Manila Hotel has worked very hard to create the perfect balance between tradition and innovation. Every renovation and refurbishment we have undertaken is part of our commitment to bring Manila Hotel to the future.

With 550 rooms today, Manila Hotel has undergone a series of dramatic renovations since our family took over ownership in 1997. We won the bidding after a Malaysian company attempted to take over the hotel’s ownership in 1995. Major modernization projects began in 2008. It began with the renovation of all the guest rooms. The interiors are more modern but still regal-looking in keeping with the hotel’s image. The next wave of renovations focused on the ho- tel’s food and beverage outlets.

How about Centro Escolar University (CEU) — do you plan to maintain its direction, or set a new course?

The CEU is being run by professional academicians and by a credible board of directors. Our direction is to expand to provinces to give the student populations outside of Metro Manila quality education, particularly in the fields of dentistry and ophthalmology.

Guided and inspired by the university maxim “Ciencia y Virtud,” the CEU seeks to be the university of first choice — the leading higher education insti- tution fostering excellence in the pursuit of knowledge while engendering per- sonal integrity and social responsibility.

We are told that you are still very much active in all your businesses. Have you ever thought of retirement?

As long as I am young and able, I will still continue to work. The younger members of my family, under my tutelage, are now at the helms of my businesses, and they are in charge of the day-to-day operations.

What is your succession plan? Is the next generation of leaders for your group in place? Are they family members?

All my sons, daughter, and grandsons are capable of working.

What advice would you give to young people starting out in business today?

Be honest and dedicated to your work. Always do good to others. Loyalty is also important.