Malaysia is known as a hub for many things: regional flying, Islamic banking, halal food. Bank Negara, the national regulator, is worried we will soon be known as the epicenter for something far more nefarious: money scams. Hot off the heels of the JJPTR collapse, Bank Negara has now added two more firms to their list of dubious financial “investment” schemes.

The list is already 302 names strong, and in them hold at least hundreds of millions of investors’ capital. The latest addition to the red-flag list are subsidiaries of MBI Group International, a company that like JJPTR, has a global network of investors, many of whom are in China. Bank Negara will alert consumers to any firm they believe practices dubious funds collection, unregulated investment practices, or fails to adhere to the law. This also includes shady outfits like JJPTR who simply took investors’ money, and funneled it out of the country.

Chinese paper Sin Chew Daily contacted MBI Group International yesterday, and spoke to chairman Tedy Teow’s assistant, who preferred to go by the name Alfa. How very Matrix of them. When asked if the firm was planning to hold a press conference to assuage investor worries regarding the latest red-flagging, Alfa was quoted as saying it was unnecessary, and that the firm would proceed with the work they have been doing. No quote from Morpheus, as of yet.

The Star spoke to an investor, H L Teoh, who fronted a RM22,500 principal earlier this year. He told the paper that he has since been given 10,000 game redemption credits. Let’s make it clear. “Game redemption credits” are not the same as getting money back. Remember when you would go to the arcade, and you would pay RM5 in credits to get back a toy valued at approximately RM1? It’s a similar analogy.

The credit that Mr Teoh was referring to are loyalty points of sorts, that can be used to barter goods in affiliated companies, among them a supermarket, restaurants, a gym and even a durian stall. One may find themselves asking, if you’re giving money to get points to them use them at the market, why not just cut out the middle man and spend them directly at the market?

However, Mr Teoh was not deterred by this, and affirmed his confidence in the scheme. “Actually, I can start selling it every six months [ed: Ok, do that but fast], but I was advised to wait for it to grow bigger in three years [ed: Mr. Teoh. No.]. When you have lots of credit, it is like having a lot of virtual shares [ed. Sir, those aren’t real and that’s not how it works]. Now, I will have to wait for further instructions from the company [ed: Oh no, I’ve lost you] before my next course of action,” he said.

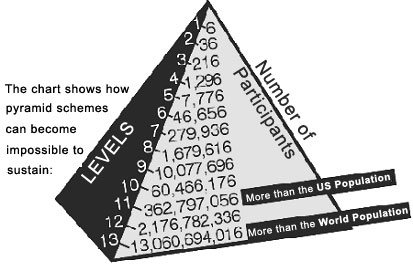

With a loss rate of 99% in most schemes, let’s hope those are some good instructions.