Who is UGL?

UGL Limited is an engineering company listed in Australia. It was one of the bidders for real estate services company DTZ Holdings, for which incumbent Chief Executive Leung Chun-ying was on the board of directors and Asia-Pacific chairman until November 2011. The company successfully acquired DTZ on 4 December, 2011, 10 days after Leung resigned from the board.

How did the UGL incident unfold?

Australian newspapers The Sydney Morning Herald and The Age, both of which are owned by Fairfax Media, published an investigative report on October 8, 2014, exposing an agreement between Leung and UGL on December 2, 2011 – months before he was elected as the chief executive in March 2012 – for Leung to receive a payout from UGL.

Australian journalist John Garnaut, who co-wrote the report, said his team received the documents from an anonymous source. He also said that Leung’s lawyers had “threatened” legal action if he published the report.

What’s in the agreement?

UGL agreed to pay Leung a cash bonus of GBP1.5 million (HKD18.7 million) and a formal payment of GBP4 million (HKD50 million) — owed to him by DTZ — in late 2012 and late 2013, respectively. In return, Leung was required to undertake non-compete, non-poach arrangements in the 24 months after the acquisition, and provide assistance in promoting UGL and DTZ, including acting as a referee and advisor from time to time during the acquisition process. Leung signed the agreement after adding the note “provided that such assistance does not create any conflict of interest” next to the latter clause.

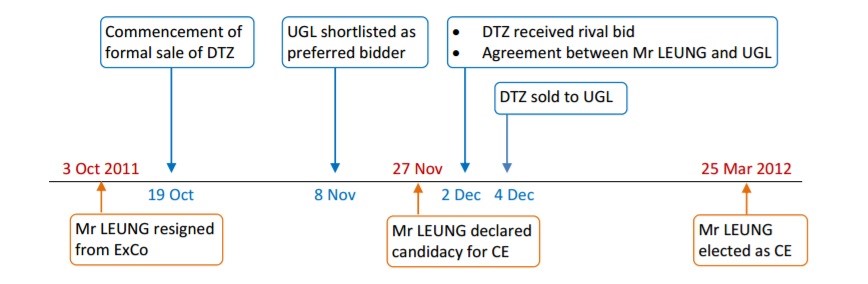

Timeline of the case leading up until Leung took office as the CE:

What’s wrong with it?

The UGL incident has been discussed as a key subject at least 10 times at the Legislative Council. Legislators have brought up four major concerns:

- The nature of the payment: Some lawmakers have called the payments an “illicit kickback” in return for Leung’s support of UGL’s acquisition of DTZ. As Leung had agreed to provide assistance to UGL and received the payments while in office, it prompted concern that he had engaged in a “part-time job” during his tenure as the CE. Lawmakers also questioned why the agreement was made privately and not declared in the main merger and acquisition contract, as per convention.

- Potential conflict of interest: Leung was accused of having a conflict of interest as he owns shares of DTZ Japan, a foreign branch of DTZ. One of DTZ Japan’s important clients was the major shareholder of a television company in Hong Kong. Lawmakers questioned if the link had complicated Leung’s decision on applications for domestic free television program service licenses. Leung stated that the business operation of DTZ Japan did not “touch upon Hong Kong and the mainland”.

- Relevant systems of declaration of interests: Leung has been criticized for failing to declare the UGL payments both during his tenure as president of the Executive Council (1999-2011), and upon assuming his role as chief executive in 2012. During a Legislative Council meeting on October 29, 2014, Chief Secretary Carrie Lam (now chief executive-elect) argued that no declaration was necessary as the payment arose from Leung’s resignation from DTZ, and did not require him to provide any future services. Furthermore, Lam said that Leung had no obligation to declare the payment as the agreement was signed after his resignation from the Executive Council and before he took office as chief executive.

- Tax implications: According to the government, Leung made a tax payment for the first payment (the cash bonus of GBP1.5 million/HKD18.7 million), but not second, formal payment of GBP4 million (HKD50 million). Leung’s critics have argued that the UGL payments involved services to be provided in Hong Kong and thus should also be taxed.

Who is/are investigating the matter?

- Secretary for Justice Rimsky Yuen delegated full responsibility to Director of Public Prosecutions Keith Yeung to handle the case.

- The Independent Commission Against Corruption (ICAC) has been investigating the matter in response to a complaint from Democratic Party lawmaker Lam Cheuk-ting. However, the anti-graft body drew controversy in 2016 after it was speculated that top investigator Rebecca Li had been sacked over her probe into the UGL case.

- In 2014, then-Australian Senator Christine Milne asked the country’s federal police to investigate if the deal broke foreign bribery laws.

A scandal within a scandal

Pro-establishment lawmaker Holden Chow was forced to quit the Legislative Council select committee probing the UGL payment last week after he was revealed to have allowed Chief Executive Leung to edit a proposed document establishing the probe’s parameters. Both Leung and Chow admitted to the incident but said there was no wrongdoing. In a tit-for-tat move, Leung repeatedly urged pan-democratic lawmaker Kenneth Leung to leave the investigation committee because of an ongoing defamation lawsuit in which the CE is suing the legislator for alleged defamation (over, you guessed it: the UGL payments).

What’s going to happen?

The ICAC’s investigation against the CE is ongoing. If charged, Leung will be the second Hong Kong chief executive to be prosecuted after Donald Tsang, though Tsang was already out of office by the time he was tried on corruption charges.

Despite the fact that Leung will finish his term as the chief executive in five weeks, 28 pan-democratic lawmakers filed an impeachment motion against him on Monday for allegedly abusing his power by intervening in the probe. The motion is expected to be tabled on June 7th.

Reader Interactions