As online businesses grow in value and popularity, the Revenue Department has decided to propose that the Finance Ministry collect taxes from internet traders.

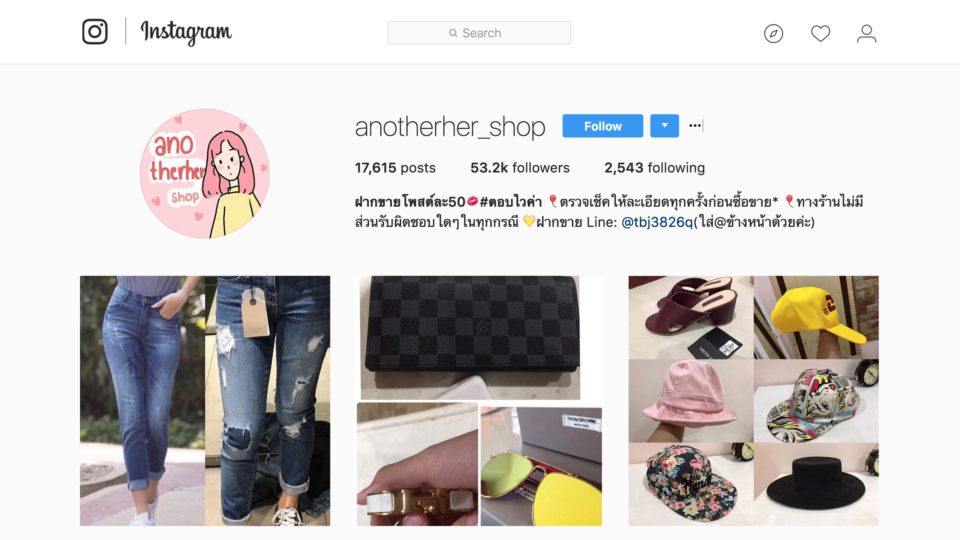

These online businesses, which include internet retailers, can be found on sites such as Instagram and Facebook.

The Revenue Department director-general, Prasong Poontaneat, said that the bill is still under consideration, but will be ready for proposal this month.

Phavud Pongwithayaphanu, president of the Thai E-commerce Association and the founder and CEO of Tarad Dot Com, agreed that this tax collection will legalize and legitimize online businesses, reported Thai PBS.

A key term from the bill states that all online business transactions made nationwide, including all forms of electronic money transfer, will be subject to taxation, even if the business operators are outside of Thailand.

The tax ceiling rate has been set at 15% instead of the 5% that was suggested earlier. Prasong, however, ensured that taxes will be fair.

The tax percentage will depend on the business type, as well as tax exemptions and deductions.

Rather than using coercive force, the government will attempt to educate online retailers so that they voluntarily obey the tax system.